What Is Smartsourcing?

Smartsourcing in healthcare is a business strategy that shifts an organization towards partnerships focusing on its core competencies and mission. It enables organizations to shed processes that are not core to their mission to a partner. The partner takes responsibility for these offloaded processes, as they align with their core competencies. The primary goal of smartsourcing is to ensure every task in a value chain is performed by an organization for which it is a core competency.

Table of Contents

- The Evolution of Hospital Outsourcing

- The Smartsourcing Approach

- Smartsourcing vs. Outsourcing

- What Functions Are Ripe for Smartsourcing?

- The Future of Smartsourcing in Healthcare

- The Ownership Dilemma: To Own or Rent?

The Evolution of Hospital Outsourcing

Initially, your hospital worked with vendors and wholesalers that delivered the equipment and supplies your employees need to take care of patients. Later, hospitals began outsourcing certain non-medical functions like housekeeping, security, and meal preparation to companies that could apply economies of scale. This approach relieved hospital administration of the responsibilities of hiring, training, and managing individual employees.

Many hospitals applied a similar outsourcing approach to high-skill functions like IT and even around-the-clock medical specialties like emergency department physicians and radiologists.

As healthcare becomes ever more complicated and financial margins ever harder to achieve, hospitals are looking for ways to improve medical and financial outcomes beyond the low-hanging fruit of vendors offering the best prices on supplies and service providers that primarily manage low-cost staff hours. Hospitals, especially independent community hospitals that may have trouble recruiting and retaining top-level expertise, are looking for strategic partners in healthcare that bring significant domain expertise and assume more of the technical functions that are required by modern healthcare.

A key consideration in evaluating these partnerships is the opportunity cost in healthcare. Hospitals need to assess whether the resources spent on maintaining non-core functions could be better allocated to areas directly impacting patient care and outcomes.

Shifting to Strategic Partnerships

According to Thomas Koulopoulos, chairman of the Boston think tank Delphi Group, the future of healthcare is Smartsourcing. Instead of recruiting and maintaining individual expertise for every business process, a hospital can contract with organizations that specialize in functions that are peripheral to the hospital’s core mission of high-quality patient care. Certain functions can be entrusted to experts who are not necessarily on-site but nonetheless share the hospital’s goals.

The Smartsourcing Approach

In short, smartsourcing in healthcare is a business strategy of shifting towards partnerships that focus an organization on its core competencies and core mission, offloading the processes that are not core to the organization’s mission to a partner.

“The processes that are ‘shed’ become the responsibility of another organization for which, in turn, these processes are core,” Koulopoulos wrote in his book Reimagining Healthcare. “The objective is to make sure that every task in a value chain of activities is ultimately performed by an organization for which it is a core competency.”

“Smartsourcing is founded on a fundamental premise, that the cost and friction of maintaining a large vertically integrated infrastructure of non-core activities is greater, and less effective, than the cost of coordinating an external value chain with the same activities among partners who are core in these same areas. This is key to understanding the shift that is occurring among community hospitals and hospital systems, physicians’ groups, and which will ultimately impact all healthcare providers.”

This collaborative approach is evident in the way healthcare providers now handle specialized tasks like clinical data abstraction. The ROI of outsourcing data abstraction is significant because it enables clinical teams to refocus their expertise on improving patient outcomes instead of routine tasks.

Lessons from the COVID-19 Pandemic

As little as 3 years ago, the notion of utilizing remote teams rather than having all employees in-house may have given hospital leaders pause. However, the COVID-19 Pandemic served as an unprecedented field test of remote work, settling the debate once and for all of whether physical presence was required to perform timely and reliable work. Hospitals that abandoned the in-house-is-best myth discovered they removed an enormous barrier to recruiting top talent — geography.

Koulopoulos asserts that smartsourcing partners, called HSPs — healthcare services providers — have every incentive to continually innovate rather than merely streamline existing processes. Their survival, like that of their hospital partners, depends on being cutting-edge in their area of expertise.

Smartsourcing vs. Outsourcing

While the terms outsourcing and smartsourcing may sound interchangeable, there are some key distinctions between the two business strategies.

First, outsourcing is usually driven purely by cost-cutting. When the organization outsources a process, it sheds not only the process but also all of its employees who were once responsible for that process. Consequently, this solution only replaces the status quo (i.e. it doesn’t enable more resources to focus on core competency work.) A common application of outsourcing in healthcare is food services. This business function can be shed to a company for which that process is core. But the staff who formerly handled that function internally wouldn’t be the skillset to refocus on core competency work of improving care.

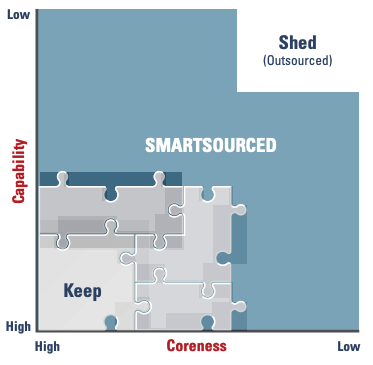

Koulopoulos writes, “While an organization may be able to define its core competencies—which it will keep in-house— and its extreme outliers—which it will outsource—the area in-between these two extremes is often difficult to outsource since it is still intimately linked to supporting the organization’s core.”

In healthcare, the reasons to outsource often include reducing operational costs, accessing specialized expertise, and improving service efficiency. However, it’s important to address common objections to outsourcing, such as concerns over loss of control and the impact on employee morale.

A perfect example of this is data collection related Core Measures and Registries like NCDR or Get With The Guidelines (GWTG). The accuracy and timely availability of this data is critical to supporting performance improvement. But the abstraction of the data from medical charts is not in and of itself core competency work. That’s where an expert smartsourcing partner comes in.

Key Differences: Smartsourcing vs. Outsourcing

While there are multiple traits that differentiate smartsourcing from outsourcing, the most telling distinctions are as follows.

- Unlike outsourcing, smartsourcing is driven by the need to innovate while keeping the employees of the original organization in place.

- Smartsourcing is also a strategic decision by an organization to invest more of its resources into developing its core competency while partnering on those areas that are outside of the core.

- The intimacy of the relationship between the healthcare organization and HSP is perhaps the most telling feature that differentiates the two concepts. With outsourcing, it may feel like the vendor operates at arms length or even in a black box. With smartsourcing, coordination with the partner is frequent, seamless, and feels like the partner is an extension of your team. Unlike an outsourcing partner that you may rarely need to interact with, a smartsourcing partnership is characterized by an intimate bond of trust, collaboration and accountability.

- And last and perhaps most important, a smartsourcing partner innovates on the process you hand over because it’s their core competency. “Improving process excellence and promoting innovation are not prime objectives of the outsourcing process,” Koulopoulos wrote.

What Functions Are Ripe for Smartsourcing?

The answer to this question will depend entirely on your healthcare organization’s core competencies, and acknowledging that another organization might be more competent can be hard. In 2019, John Muir Health in the San Francisco Bay Area embraced smartsourcing in a big way by entering a multi-disciplinary contract with an HSP called Optum that includes managing the revenue cycle, some care management, information technology, and the purchasing department.

According to Koulopoulos, the payback for John Muir Health is expected to be $300 million a year. But, in a webinar, CFO Chris Pass described two unexpected ways that the smartsourcing relationship promptly proved its worth when the COVID-19 pandemic arrived less than a year later. One was leveraging the HSP’s purchasing power and vendor relationships for PPE. Another was having a “virtual” workforce already in place when California’s shelter-in-place and social distancing policies dramatically limited the number of employees who could come to the office.

Why Not Just Merge?

Merging to create or become part of a bigger healthcare organization certainly remains one option for helping community hospitals and physician groups survive. However, the cost savings achieved by mergers, typically less than 3.5%, may be matched by reductions in revenue. Moreover, innovation for all merger partners will be at the mercy of the umbrella organization.

If the goal is more than survival, smartsourcing non-core functions by partnering with highly specialized HSPs can be the path to “radically alter the infrastructure of health care,” as Koulopoulos puts it.

Muir “never missed a step,” Pass said. “When we entered into this [smartsourcing relationship], it was the last thing on our mind that we thought we would have to be concerned with.”

The Future of Smartsourcing in Healthcare

Loma Linda University Health, in California, is another example of smartsourcing in action. Assistant Vice President of Quality & Patient Safety Brenda Bruneau, MBA, RN, is a strong proponent of smartsourcing the data collection process so she can make more strategic use of her clinical personnel and focus them on their core competency — improving care. “My former abstractors are now stronger partners with our operations teams, like our physicians or our nurse clinicians, in really understanding and dissecting the data, and being able to participate in quality improvement,” Bruneau said. “Their clinical brain is now transitioned from abstraction to partnering in making our performance better. And that’s been a big win for many of our teams.” (Loma Linda works with American Data Network as its systemwide smartsourcing partner for data abstraction.)

Loma Linda received national recognition at an Epic EHR conference where they presented on a Stroke Treatment Documentation project that was made possible through smartsourcing. “In many of our Comprehensive Stroke measures, we were struggling,” said Bruneau. So she tasked her former abstractor to team up with the operations and Epic EHR teams to create a summary view. As various individuals are feeding the EHR, it creates a real-time picture of each episode of care for stroke patients. “It displays a coalition of information for all of our providers to see the summary of the trajectory of that stroke patient to make sure that all of those elements that are required in our performance are actually met. And if they’re not, it identifies it.” For example, Bruneau said, if the NIH score was not documented on admission, the electronic summary presents it to the clinician as a missing element so that it can be addressed in a timely manner.

Rather than focusing on her previous job duty of routine data collection, Bruneau’s team member was able to innovate instead, becoming an active change agent rather than a passive data collector. That is a textbook example of the innovation enablement created by a solid smartsourcing partnership. “We now routinely achieve high compliance with Comprehensive Stroke,” Bruneau said. “That work was able to be done because the individuals who know that data best were able to partner with our operations and Epic teams to say, ‘How do we do this better?’”

The Ownership Dilemma: To Own or Rent?

What Loma Linda and John Muir are doing is certainly forward-thinking in healthcare. Nonetheless, the concept of smartsourcing has long had a foothold in other industries.

The shift to “the cloud” in IT illustrates how the industrial age “economies of scale” status quo has been disrupted. Today, it’s no longer effective or cheaper for an IT department to build and manage servers at every company.

In an economy full of services based on knowledge work, no one could argue that file sharing and storage are not critical components in the value chain. But because of innovation in technology, it’s now much cheaper and more effective to rent rather than own that part of the value chain.

Bruneau emphasizes that quality teams considering smartsourcing data abstraction must shift their mindset away from the economies-of-scale approach (that many hospitals are still stuck in). “I think it’s important to understand that when you smartsource, it doesn’t mean you let go of the accuracy or the completion of that data. You don’t ever let go of that,” said Bruneau. “However, when I smartsource it, I have another partner. And I am not solely responsible for the obtaining of that data. It actually makes it easier because a smartsourcing organization has a little broader ability. They’ve got a few more people than you likely have.”

Post-outsourcing strategies are critical in this context. Once functions are smartsourced, organizations must ensure that their core teams focus on innovation and continuous improvement, leveraging the freed-up resources. This strategic approach not only enhances service quality but also maximizes the ROI of outsourcing.

Healthcare organizations like Loma Linda and John Muir are realizing that to survive and thrive in a market of accelerating technological advancement coupled with intensifying economic pressure, they have to be more agile. To achieve this agility, they need to narrow their focus to core competencies and partner on peripheral processes that might hinder core innovation.

By eliminating friction caused by administrative processes that distract them from their core competency, leading hospitals move faster, innovate more, improve quality teams, and deliver better care while growing revenue.